2014 Vol24 N1

http://www.omic.com/wp-content/uploads/2014/05/Digest-4-15-14.pdf

How to Educate Yourself on Malpractice Risk Even Before You Begin Practice

During your career, you’ll spend $250,000 to $500,000 on malpractice insurance. Making smart decisions early on can help lessen the financial burden. Here are some tips on getting up to speed on malpractice insurance prior to completing your residency or fellowship:

Participate in Risk Management

If you should be unfortunate enough to have a large malpractice settlement or judgment against you, it could follow you throughout your career. You may be forced into a non-standard insurance market that increases your premiums substantially. It may have ramifications on your application or credentialing for various organizations. Do your best to avoid being in this situation by following good ethics, practicing conservatively, and staying educated on loss prevention strategies. In OMIC’s case, we look at standard of care, documentation, and ethics much more carefully when evaluating past claim history than we do the amounts cases were settled for. We do not have a perfect legal system. Sometimes in the lack of any malpractice, claims are settled or plantiffs are awarded damages. Conversely, sometimes even when no payment was made or the case ended with a defense verdict, there could have been concerns about the SOC (or other factors). By following a thorough and conservative practice pattern, even in the case of serious outcomes such as total blindness, cases are easier to defend and it’s more likely you will not have problems with obtaining coverage.

OMIC provides credit for any course taken up to 12 months before joining, therefore you can earn a discount on your first premium with OMIC by participating when you are still a resident or fellow. We will keep records of your attendance but you can also indicate the details of the OMIC course you participated in on your initial application with OMIC and we’ll make sure you get your credit. View the OMIC Calendar for upcoming seminars. Related reading: >> See the bottom-line effects of risk management credits over time

Take a Tour of OMIC’s Web Site

The Ophthalmic Mutual Insurance Company is not like other insurance carriers. We are devoted to our single specialty of ophthalmology, we are owned by our 4500+ ophthalmologist policyholders and we are governed by practicing ophthalmologists. You can think of us more like an Academy sponsored risk management program that strives to prevent ophthalmologists from being the targets of litigation and if necessary vigorously defend our insured and our specialty within the legal system. To this end, we have amassed a vast library of resources and tools including hundreds of consent forms, recommendations, protocols, articles, case studies, and sample letters. We make our information available to everyone, whether insured (or intend to be insured) or not, with the hope that these materials will improve patient safety and strengthen the entire specialty. In the end a rising tide lifts all boats, as they say. OMIC’s site has four main pages, Risk Management, Policyholder Services, News, and About Us, you may want to start exploring there. Take some time to navigate the site and give us your suggestions on how we can continue to improve.

Support Your Local Societies

OMIC partners with almost every ophthalmic society in the United States to disseminate education and provide jointly-sponsored events. We provide special premium discounts for events approved by our partners that pay most or all of the cost of membership so your support is easier than ever. Be in the habit of supporting local lobbying efforts as the “front lines” are where most of the battles for scope of practice and tort reform are waged. Find out if your state, subspecialty, or special interest ophthalmic society has a current partnership with OMIC by viewing our Educational Alliances page.

Contact OMIC

OMIC representatives are available to help you understand any ophthalmic malpractice insurance or risk management issue. Although our Hotline is available exclusively for policyholders once you start practice, we are happy to provide young ophthalmologists guidance when you need it. If we can help you, we will. So give us a call and let us know what is on your mind. There are no silly questions to us. Start by calling Reana at (800) 562-6642, ext. 661 and she will help you or get you to someone who can. We look forward to hearing from you!

Denise Chamblee is New Risk Management Chair

The OMIC Risk Management Department welcomed a new committee chair and risk management specialist earlier this year. Denise R. Chamblee, MD, a pediatric ophthalmologist in Newport News, VA, and an OMIC Board member, will chair OMIC’s Risk Management Committee. Since joining the Committee in 2008, Dr. Chamblee has been a major contributor to the development of OMIC’s retinopathy of prematurity hospital and office safety nets. She also works closely with the American Academy for Pediatric Ophthalmology and Strabismus on ROP-related patient safety/quality of care issues. Dr. Chamblee is a graduate of the American Academy of Ophthalmology’s 2013 Leadership Development Program.

The OMIC Risk Management Department welcomed a new committee chair and risk management specialist earlier this year. Denise R. Chamblee, MD, a pediatric ophthalmologist in Newport News, VA, and an OMIC Board member, will chair OMIC’s Risk Management Committee. Since joining the Committee in 2008, Dr. Chamblee has been a major contributor to the development of OMIC’s retinopathy of prematurity hospital and office safety nets. She also works closely with the American Academy for Pediatric Ophthalmology and Strabismus on ROP-related patient safety/quality of care issues. Dr. Chamblee is a graduate of the American Academy of Ophthalmology’s 2013 Leadership Development Program.

Michelle Pineda joined the OMIC staff as a risk management specialist in February. Ms. Pineda has a Masters of Business Administration from St. Mary’s College in Moraga, CA, and brings years of work experience with a large medical professional liability carrier and Bay Area high tech companies. She will work with Anne Menke, RN, PhD, and Hans Bruhn, MHS, to handle confidential hotline calls and other risk management queries from insureds.

The Risk Management Department also has a new fax number, 415.771.1095, for all risk management-related business. The department’s phone number is still 800.562.6642, option 4. Risk management queries can also be emailed to riskmanagement@omic.com.

Adding Up: The Bottom Line Effects of Risk Management Credits Over Time

By Robert Widi VP Sales and Marketing

You’ve heard it before, put the 3 bucks you spend on coffee each day into your 401k and you’ll be amazed at how much money you’ll amass for retirement. We’re talkin extra ultra venti here. Three bucks a day, 30 days a month, twelve months a year…well you get it, adds up to tens, even hundreds of thousands of dollars… So what if we place the same kind of lens on your malpractice insurance policy. Here is one of the easiest credits to earn on your premium and it can really add up.

Risk Management

Educational credits are the best of all earned credits because you can earn and learn. Don’t underestimate the value of information disseminated at our seminars, we’ve had cases literally won or lost based on the principles that are discussed at courses because they tend to highlight the problems we’ve encountered in earlier claims. I will never understand why anyone would not take advantage of this valuable benefit if your carrier provides it. Yet amazingly, nearly half of OMIC’s policyholders did not receive a discount in the past year, and OMIC has one of the highest risk management participation rates in the country.

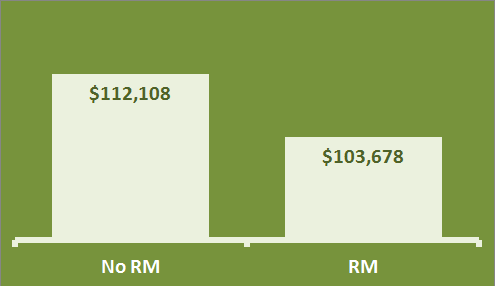

I did a comparison shown in the chart to the right of an average 10-year cumulative cost of insurance for an insured who participates in risk management each year and one who does not. You can see there is a difference of approximately $8,500 over a 10-year period. So, for spending approximately 10 hours (the avg OMIC risk management seminar is about an hour) over 10 years, you earn more than eight grand, $850 bucks an hour, for your time. Call me crazy but this seems like a no-brainer to me. Now let’s talk about group practices. There you really got a head scratcher. $8500 x 5 = well you do the math.

So the take-away is, don’t lose out on your chance to earn credits where they’re easy and free. Think of it kinda like a “buy 10 sandwiches and the tenth is free” card. I hope this helped put the power of discounts front and center in your mind. For more information on OMIC’s risk management program go here.

Monocular Patient Loses Vision After Vitrectomy

Ryan Bucsi, OMIC Senior Litigation Analyst

This is a recently closed claim study of the Ophthalmic Mutual Insurance Company.

Digest, V24 N1 2014

Allegation

Lack of informed consent of increased risk of bleeding during elective vitrectomy in a patient taking Plavix and aspirin.

Disposition

Case settled for $825,000.

Case Summary

A 77-year-old female patient was referred to an OMIC insured with a history of blindness OS following a stroke several years earlier, as well as diabetes and hypertension. She had previous cataract surgery OD with 20/40 visual acuity and complained of seeing “specks.” The insured diagnosed marked asteroid hyalosis and, although the retina was attached, he recommended a vitrectomy to reduce the floaters. The insured was aware of the patient’s history of stroke and lost vision OS and that she was taking Plavix and aspirin, but he did not have her discontinue these medications prior to surgery. Towards the conclusion of the vitrectomy, the patient developed a bleed that led to a retinal detachment. Unable to isolate the bleed, the insured closed the eye and scheduled a subsequent procedure one week later to remove the blood and reattach the retina using silicone oil. It was noted during this second procedure that there was extensive clotting from the previous procedure.

At this point, the insured consulted with the patient’s primary care physician, who decided to discontinue the Plavix. Two weeks later, a third procedure was performed to remove additional blood. The retina was detached for the removal of blood and reattached at the conclusion of the procedure, again using silicone oil. The insured then consulted with his partner as there was still some blood present in the eye and the retina continued to detach following each surgery. With the insured present, the partner performed a fourth surgery six weeks later in an attempt to remove all the remaining blood and reattach the retina. The surgery was successful in reattaching the retina, but all the blood could not be removed as the patient continued to bleed during the procedure. A final examination revealed a white optic nerve and indicated that blood underneath the retina for a prolonged period of time may have caused damage to the photoreceptors. The patient had nerve atrophy, atrophy of the eye itself, and NLP OD, rendering her completely blind.

Analysis

Our defense experts were split on whether it was within the standard of care to operate on this patient without first consulting her primary care physician about safely taking her off Plavix and aspirin prior to surgery. However, our experts unanimously agreed that a separate informed consent should have been given to the patient specifically detailing the risk of hemorrhage, retinal detachment, and potential loss of sight.

During his deposition, the insured testified that he had no discussions with the patient about an increased risk of bleeding, retinal detachment, and loss of vision because the vitrectomy was done in an avascular area and bleeding was not expected. Our experts disagreed and felt that bleeding was indeed a risk and since the patient had sight in only one eye, there should have been a more thorough review and discussion of all the risks associated with surgery. Indeed, the main weakness of the case was the apparent imbalance between the expected benefit of surgery to remove floaters and the potential risk of blindness in a functionally monocular patient.

Risk Management Principles

The patient history and physical exam were appropriately performed and documented; however, the insured did not take into account that the findings indicated an increased risk for bleeding and retinal detachment, which could lead to blindness in the patient’s remaining good eye. The patient was never informed of these possible complications and did not have the opportunity to make a well-informed decision about moving forward with a procedure that carried significant risks. Additionally, as pointed out by one of OMIC’s defense experts, since this was an elective procedure, a detailed, welldocumented discussion of the risks would have benefited the doctor when complications arose.

OMIC has a sample consent form to use with surgical patients who are taking anticoagulants. See it here.