Risk Management

| << Back | Download |

Adding Up: The Bottom Line Effects of Risk Management Credits Over Time

By Robert Widi VP Sales and Marketing

You’ve heard it before, put the 3 bucks you spend on coffee each day into your 401k and you’ll be amazed at how much money you’ll amass for retirement. We’re talkin extra ultra venti here. Three bucks a day, 30 days a month, twelve months a year…well you get it, adds up to tens, even hundreds of thousands of dollars… So what if we place the same kind of lens on your malpractice insurance policy. Here is one of the easiest credits to earn on your premium and it can really add up.

Risk Management

Educational credits are the best of all earned credits because you can earn and learn. Don’t underestimate the value of information disseminated at our seminars, we’ve had cases literally won or lost based on the principles that are discussed at courses because they tend to highlight the problems we’ve encountered in earlier claims. I will never understand why anyone would not take advantage of this valuable benefit if your carrier provides it. Yet amazingly, nearly half of OMIC’s policyholders did not receive a discount in the past year, and OMIC has one of the highest risk management participation rates in the country.

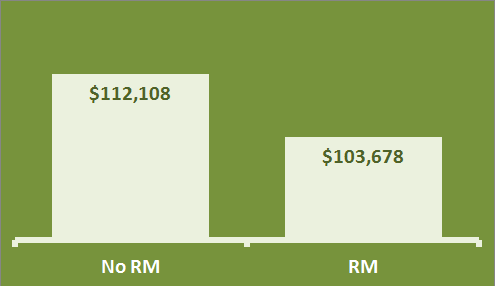

I did a comparison shown in the chart to the right of an average 10-year cumulative cost of insurance for an insured who participates in risk management each year and one who does not. You can see there is a difference of approximately $8,500 over a 10-year period. So, for spending approximately 10 hours (the avg OMIC risk management seminar is about an hour) over 10 years, you earn more than eight grand, $850 bucks an hour, for your time. Call me crazy but this seems like a no-brainer to me. Now let’s talk about group practices. There you really got a head scratcher. $8500 x 5 = well you do the math.

So the take-away is, don’t lose out on your chance to earn credits where they’re easy and free. Think of it kinda like a “buy 10 sandwiches and the tenth is free” card. I hope this helped put the power of discounts front and center in your mind. For more information on OMIC’s risk management program go here.

Please refer to OMIC's Copyright and Disclaimer regarding the contents on this website