Risk Management

| << Back |

Coverage Evolves To Meet New Risks

By Betsy Kelley

OMIC Underwriting Manager

Digest, Summer 1999

Technological advances, demographic shifts, and socioeconomic forces over the past decade have brought about profound changes in the practice of ophthalmology and the resulting liability exposure. Through the years, OMIC has responsibly modified its coverage features and liability limits to meet these changes.

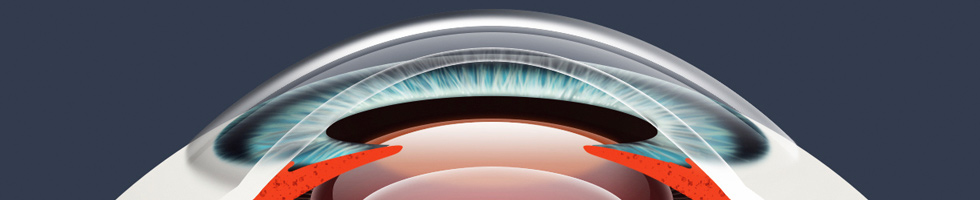

Refractive Surgery

Until 1995, virtually the only surgical option for treatment of myopia was radial keratotomy (RK). Then in 1995, the FDA approved the Summit laser for photorefractive keratectomy (PRK). Since that time, LASIK has essentially become the procedure of choice for many. Meanwhile, several other refractive surgery options have emerged, and OMIC has extended coverage to insureds who perform these procedures: RK/AK, PRK, ALK, LASIK, Intacs, Clear Lens Extractions, and Phakic Implants for refractive purposes.

In the past year, OMIC has modified at least six existing guidelines for refractive surgery and developed guidelines for Intacs. Recent policy modifications include:

The maximum degree of myopia for PRK and LASIK was increased in recognition of changes in FDA-approved guidelines.

The minimum age for PRK using the Summit laser was lowered to 18.

The required one-week interval between primary PRK and LASIK procedures may be waived for experienced surgeons who qualify, subject to special consent requirements.

The 10 surface PRK requirement was discontinued to allow physicians with limited or no prior PRK experience to qualify for LASIK coverage provided they are certified on the laser and are proctored for their first five LASIK cases.

Cosmetic Surgery

Many ophthalmologists have expanded the scope of their practice to include laser skin resurfacing, laser hair removal, and other cosmetic surgery procedures, including facelifts and liposuction. Subject to underwriting review and adherence to guidelines, coverage for such cosmetic procedures is now available to qualified ophthalmologists.

Part-time and Tail Coverage

While OMIC has always offered part-time rates to ophthalmologists who limit their practice to medical ophthalmology, recently this discount was extended to qualified insureds who perform surgery as well. Eligibility for a part-time discount is based upon the number of practice hours, scope and volume of practice, and claims history, among other things.

Recognizing that an increasing number of ophthalmologists may elect to retire at an earlier age, OMIC discontinued its age requirement for free tail coverage upon retirement and, more recently, reduced the length-insured requirement. Now, an insured who retires permanently from the practice of medicine at any age qualifies for a free tail provided he or she has been continuously insured with OMIC for at least one year (see note below). OMIC also provides a free tail upon death or disability, regardless of age or length of time insured with OMIC.

Liability Limits

Legislative changes have prompted requests for more flexible coverage options in certain states. OMIC now offers limits of $400,000 per claim/$1,200,000 aggregate to insureds who practice in Pennsylvania; $250,000/$750,000 in Indiana; and $1,500,000/$4,500,000 in Virginia. OMIC also considers, on a case-by-case basis, requests by insureds for non-traditional limits. (Note: the limits noted here applied in 1999 – limits in PA and VA have increased since this article was written)

New Entity Exposures

OMIC realized the need to develop guidelines accommodating the liability exposures associated with shared management of post-operative patients. OMIC will directly insure qualified employed optometrists as additional insureds under the physician’s policy and, in certain limited circumstances, may extend coverage to the entity and/or optometrist in cases where the optometrist owns a portion of the practice.

To remain financially viable, ophthalmic surgery centers often must allow other specialists to use their facility. Thus, OMIC has developed appropriate underwriting guidelines and rates that permit the company to insure the surgery center for its vicarious liability exposures arising from ophthalmic and non-ophthalmic procedures. At the request of an insured network, OMIC also developed a program for coverage of qualified eye banks.

Fraud and Abuse Coverage

In response to the federal government’s zealous efforts to root out health care fraud and abuse, OMIC now provides its professional liability insureds with a Medicare/Medicaid Fraud and Abuse Legal Expense Reimbursement Insurance policy free of charge. Academy members insured elsewhere for their professional liability coverage may purchase fraud and abuse coverage from OMIC for a nominal premium.

For more information or to request changes to your coverage, please contact any of OMIC’s Underwriting Department representatives at (800) 562-6642. For information regarding OMIC’s fraud and abuse coverage, please contact Kim Wittchow at ext. 653.

UPDATED (1/13/2013): OMIC’s retirement premium waiver was modified in 2003 to increase the required minimum period of continuous insurance from 1 year to 5 years for all new policies incepted on or after 6/1/2003 and for all individual insureds added to existing group policies on or after 6/1/2003.

Please refer to OMIC's Copyright and Disclaimer regarding the contents on this website