DIGEST V26 N1 2016

http://www.omic.com/wp-content/uploads/2016/04/Digest-V26-N1-2016.pdf

GEORGE A. WILLIAMS, MD, OMIC Board of Directors

This marks the 100th issue of the Ophthalmic Risk Management Digest for OMIC insureds and presents an opportunity to discuss the history, present status, and future of your medical liability insurance company. It is my great privilege and pleasure to become the eighth Chair of the Board of our remarkable company. To paraphrase Sir Isaac Newton, “We stand on the shoulders of giants.” One of those giants is Tamara Fountain, MD, my immediate predecessor, who completed 15 years of dedicated and impactful service to OMIC as a committee member, board member, executive committee member, and finally as Chair. Tamara’s wisdom, insight, and wit will be missed by the entire OMIC family.

The genesis of OMIC occurred during the medical malpractice liability crisis of the late 1980s. Many ophthalmologists were unable to obtain adequate or affordable coverage. In 1987, the American Academy of Ophthalmology under the visionary leadership of Bruce Spivey, MD, responded to this crisis by creating OMIC as an independent medical liability mutual company under the structure of a risk retention group. The founding principle was and remains that OMIC is run by ophthalmologists for ophthalmologists. This principle is the primary driver of our continuing success. No insurer knows ophthalmology better than we do.

At the time the first Digest was published in Winter 1991, OMIC covered 1,064 policyholders across 40 states with $5 million of surplus, written premium of $7 million, and total assets of $20 million. That same year, OMIC distributed a $250,000 dividend to current insureds but still required new insureds to pay a surplus contribution beyond the policy premium.

What a difference 25 years can make! Today, OMIC insures 4,692 ophthalmologists and writes insurance in all 50 states. We have surplus of $193 million and assets of $275 million. Over the past three years, OMIC has returned more than $25 million in dividends to policyholders. For 2016, premiums were cut an average of 12.8% while still paying a 20% dividend.

Today, OMIC carries an A.M. Best rating of A and consistently and substantially outperforms its peer group in frequency and severity of liability claims and payments. This financial strength provides OMIC with new opportunities to become an even more effective advocate and protector for our insureds, our profession, and most importantly, our patients.

In future editions of the Digest, I will discuss OMIC’s continuing legacy of improving patient safety through risk management. Our risk experience provides a unique perspective on how we can minimize clinical errors and improve patient care. That is more than just good business. As a company of ophthalmologists, for ophthalmologists, it is our raison d’être.

Diagnostic error: Types and causes

ANNE M. MENKE, RN, PhD, OMIC Risk Manager

In September 2014, the ophthalmologists who compose OMIC’s Claims Committee noticed an increase in OMIC malpractice cases alleging diagnostic error and asked risk management staff to explore the reasons behind this apparent trend. We looked at OMIC claims that were resolved over the seven-year period from 2008 to 2014 and presented this data at the OMIC Forum at the 2015 AAO annual meeting in Las Vegas. Many of our policyholders were not able to attend the Forum, so we are pleased to share this information from the “OMIC study” in the Digest.

The prevalence of diagnostic error has been estimated to range from 10 to 15% of patients in one study1 and 7 to 17% of patients in another.2 These errors often lead to lawsuits. A study that examined claims payments reported to the National Practitioner Data Bank (NPDB) found that diagnostic error was the most common cause of claims payments (29% of all claims), and that diagnostic error claims were the most expensive (35% of money paid) and most harmful to patients.3 Another study reviewed claims in a data sharing project and found that 20% of all claims involved an allegation of diagnostic error, accounting for 35% of claims payments.4 The PIAA, a trade group whose members provide medical professional liability insurance, found that diagnostic error was the most frequent cause of member reported claims between 2004 and 2013 with the highest average indemnity payment.5 In the PIAA study of only ophthalmology-related claims (not including OMIC’s claims) since 2004, diagnostic error was the third most frequent allegation against ophthalmologists. Payments were made in 38% of these ophthalmology-related diagnostic error claims.6

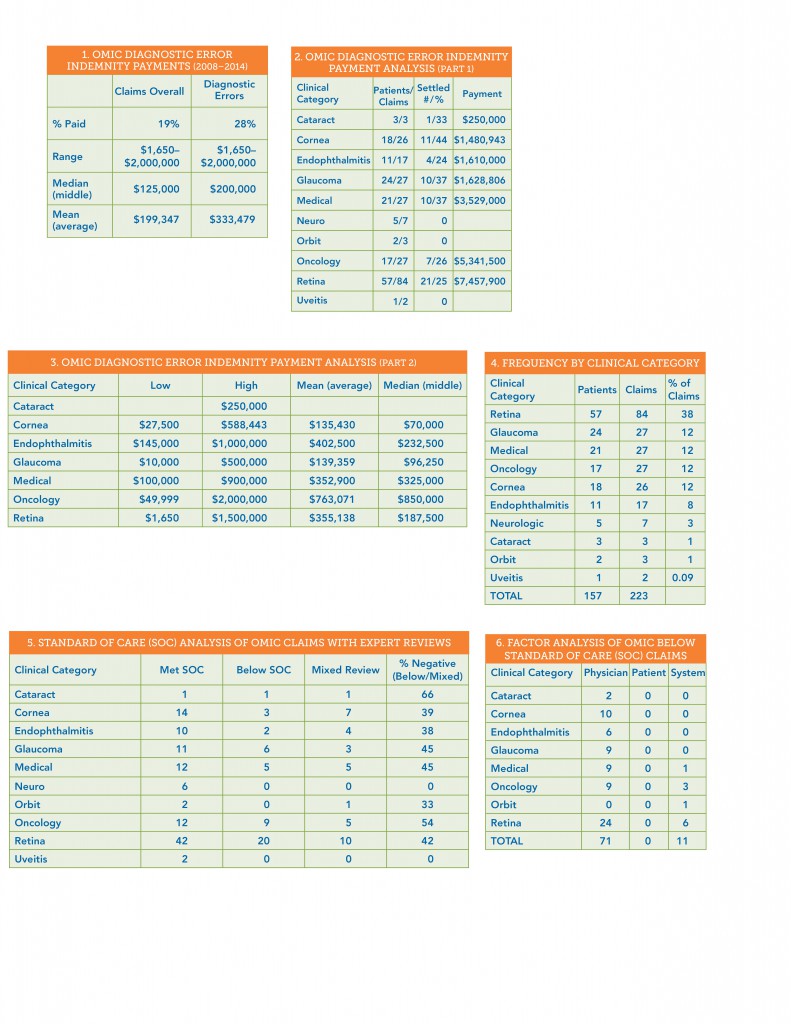

OMIC claims alleging diagnostic error

We found a smaller percentage of diagnostic error claims in the OMIC study compared with the other studies discussed above. Of the 1613 claims reviewed, 223 alleged a diagnostic error, accounting for 14% of the claims. We paid indemnity on a lower percentage of diagnostic error claims (28%), but these payments account for a similar percentage (34%) of total money paid to settle claims. When compared to all OMIC claims during the period, claims based on allegations of diagnostic error resulted in more paid claims, a higher median and mean payment, and the highest payment (Table 1). Of these diagnostic error claims, cornea claims had the highest percentage settled, while retina claims were the most frequent, had the highest number settled, and the highest total amount paid (Tables 2 and 3). Endophthalmitis diagnostic error claims are costly to settle; the lowest amount paid for these claims was $145,000. But oncology claims stand out as the top diagnostic error payment as well as the highest mean and median payments. There were no paid claims for diagnostic error in neuro, orbit, or uveitis.

Clinical categories of OMIC diagnostic error claims

When we look at the clinical categories of diagnostic error claims, retina claims far exceed all other types in both number and percentage of claims (Table 4). Glaucoma, medical, oncology, and cornea claims each represent 12% of these claims. Since ophthalmologists have many questions about endophthalmitis prophylaxis and patients tend to have poor outcomes, we made this a separate category. We will now briefly examine the clinical categories, in descending order of frequency. The table gives both the number of patients and claims. This is because the plaintiff (patient) may sue more than one physician (e.g., both the comprehensive ophthalmologist and the retina specialist) as well as a group practice or surgery center.

Retina claims. 84 retina claims account for 38% of all OMIC diagnostic error claims during this seven-year period. By far, the most frequently missed diagnosis in our entire study was retinal detachment (RD). These 65 RD claims represent 79% of the retina claims and 48% of the retina payments. The next issue of the Digest will explore these RD claims in detail. While there were only six claims for failure to diagnose retinopathy of prematurity (ROP), these claims compose 47% of the retina payments. There were three age-related macular degeneration claims. The remaining nine claims alleged failure to diagnose retinitis, bilateral acute retinal necrosis (BARN), branch retinal artery occlusion (BRAO), foreign bodies, and a macular hole.

Glaucoma claims. There were 27 claims alleging failure to diagnose glaucoma. Types of glaucoma include primary open angle glaucoma (11 claims, 5 payments), steroid-induced glaucoma (7 claims, 3 payments), narrow angle glaucoma (6 claims, 2 payments), and miscellaneous types (iridocorneal endothelial syndrome or ICE, neovascular, and phacolytic, all of which closed without a payment).

Medical (systemic illness) claims. There were 27 claims where a systemic illness presented with ophthalmic signs and symptoms. The most common of the medical conditions was giant cell arteritis or GCA (11 claims, 6 payments). We addressed these GCA claims in detail in the Digest last year (V25, N3 at omic.com in the Publications section). Systemic infections accounted for seven claims and one payment. Types included subacute bacterial endocarditis and sepsis. Although endogenous endophthalmitis is a systemic condition, we assigned those six claims to the endophthalmitis category. Failure to diagnose a cerebral vascular accident was alleged in five claims, and resulted in three payments.

Oncology claims. There were 27 claims. Failure to diagnose melanoma resulted in six claims and two payments. Pituitary tumors were allegedly missed in four claims but no payments were made. A delay in diagnosing glioma led to three claims and two payments, including a settlement of $2,000,000, the largest one in the study. There were three lacrimal cancer claims with one payment, three optic nerve tumors with no payments, and one trigeminal schwannoma claim, which settled for $1,000,000. We will explore the reasons for these expensive oncology claims and how to prevent them in an issue of the Digest later this year.

Cornea claims. Of the 26 claims, 17 alleged failure to diagnose an infection, leading to six payments. Please see the Closed Claim Study in this issue for a discussion of the challenges in correctly identifying the cause of a corneal infection. There were four keratoconus claims with two payments and four corneal ulcer claims with three payments. This category had the highest percentage of paid claims.

Endophthalmitis claims. There were 17 claims. In six claims, the patient had endogenous endophthalmitis, resulting in three payments. The other cases occurred following trauma (five claims, three payments), cataract surgery (three claims, no payments), and other conditions (one each in a drug user and following pterygium and strabismus surgery, none of which resulted in payments).

Standard of care evaluation of diagnostic error

As part of the investigation of a claim, both plaintiff and defense attorneys hire experts to review the medical records and allegations in order to determine if the standard of care (SOC) was met. To help us indentify areas of concern, we compared the SOC analysis provided by defense experts (Table 5). Of the 223 claims, 194 were reviewed by defense experts. OMIC-insured ophthalmologists were deemed to have met the standard of care in 112 claims (58%). The standard of care was not met or reviews were mixed (considered together as negative reviews) in 82 (42%) of the claims. While some categories had too few claims to draw any conclusions, we are concerned about the rate of negative reviews in oncology, glaucoma, medical, retina, cornea, and endophthalmitis. Our experts noted that the conditions that were improperly diagnosed were rarely exotic or unusual. They found that the evaluation was often inadequate (insufficient history, exam, or testing) and that results of some tests were misinterpreted. They also reported that ophthalmologists often had poor recognition of a worsening or non-responsive condition, and accordingly, did not obtain a second opinion or refer to a specialist in a timely fashion.

Factors impacting the diagnostic process

The diagnostic process is complex, impacted by many factors. These are often divided into three categories: physician (knowledge, skill, etc.), patient (condition and behavior), and system (appointment scheduling process; regulations; insurance rules; drug manufacture, ordering, and administration, etc.).4,7 We analyzed factors in claims where the experts felt that the standard of care was not met. The results are shown in Table 6. Physician factors impacted 71 out of 82 claims (87%), patients had no impact, and system issues figured in 11 claims (13%). Please see the Hotline for recommendations on addressing the physician’s role in the diagnostic process.

Our study of 223 diagnostic errors during a seven-year period validated the concerns raised by our Claims Committee. While we present some recommendations on how to reduce these claims in this issue’s Hotline, it is clear that there is no quick or easy solution. Dr. George Williams, OMIC’s new Board Chair, recently met with all OMIC staff members and informed us that his focus during his tenure will be patient safety, including the risk posed by diagnostic error. We will continue to study diagnostic error in the Digest this year and in presentations we give at state society and subspecialty meetings.

- Graber ML et al. “Cognitive interventions to reduce diagnostic error: A narrative review.” BMJ Qual Saf. 2012; 21: 535-557.

- National Academies of Sciences, Engineering, and Medicine. “Improving diagnosis in health care.” Washington, DC: The National Academies Press. 2015.

- Saber Tehrani AS et al. “25-year summary of US malpractice claims for diagnostic errors 1986-2010: An analysis from the National Practitioner Data Bank.” BMJ Qual Saf. 2013; 22: 672-680.

- Hoffman J, ed. “2014 Benchmarking Report: Malpractice risk in the diagnostic process. Crico Strategies.”

- PIAA. “Closed Claim Comparative.” 2014.

- PIAA. “Specialty Specific Series: Ophthalmology.” 2014.

- Gandhi TK et al. “Missed and delayed diagnoses in the ambulatory setting: A study of closed malpractice claims.” Ann Intern Med. 2006; 145: 488-496.

Tables

New society partnerships provide benefits for more ophthalmologists

During the past year, we’ve entered into educational partnerships with three new societies: the Wisconsin Academy of Ophthalmology, the Oregon Academy of Ophthalmology, and the Vit-Buckle Society.

OMIC maintains alliances with most ophthalmic state, subspecialty, and special interest societies in the United States. The Vit-Buckle Society is our 52nd partner organization. Through these cooperative agreements we share patient safety and risk management information and support local lobbying and tort reform efforts.

Policyholders who are members of partner societies earn a 10% risk management discount (an average premium credit of $800) when they complete an approved OMIC risk management event. Since 2000, OMIC has distributed more than $17 million in special premium discounts through this program.

Participate and save on your premium

1. Join (or maintain) state, subspecialty, or special interest partner society membership. (Go to omic.com/partners to see our current list.)

2. Participate in one jointly sponsored OMIC risk management activity per year. For some partners, a jointly sponsored event is any OMIC risk management activity, including a live seminar, audioconference, webinar, or online course. (Certain partners may require attendance at a live OMIC-society event, which is usually conducted during the society’s annual meeting.) To find out what your society requires, visit the partner page at omic.com/partners.

Risk management discounts

Premiums are reduced for physicians who participate in OMIC’s risk management program. To earn your credit, you must complete one activity per year. Credits are generally applied to the renewal policy period following the year in which an activity was completed. Your underwriter will track activity and automatically apply any applicable discounts for you.

OMIC generally awards a credit of 5% for risk management activities; however, you may qualify for a 10% discount as an active member of an OMIC partner society. We will honor the credit for approved activities non-OMIC physicians complete within one year of joining OMIC.

If you believe you have not received credit for completing an OMIC-sponsored risk management course, event, or activity, speak with your underwriter. For contact information or to identify your representative, visit omic.com/policyholder-services/contact-my-rep/underwriting.

What can physicians do to improve diagnostic accuracy?

ANNE M. MENKE, RN, PhD, OMIC Risk Manager

When we presented the data from our study of diagnostic error at the 2015 OMIC Forum, we asked the ophthalmologists in the audience to vote on what factor contributed the most to diagnostic errors. The choices were: atypical presentations (patient factors), physician’s cognitive process (physician factors), failure to follow up on test results (system issues), or poor communication among healthcare providers (system issues). Most ophthalmologists voted for the two types of system issues. However, when we analyzed factors in claims where the experts felt the standard of care was not met, we found instead that physician factors were the main force driving these claims (87%). System issues figured in only 13% of the claims, and patient factors in none. The correct answer to our audience response question was, therefore, the physician’s cognitive process.

Q What do we know about the cognitive process?

A There have been many studies on decision-making in general and a growing number on clinical reasoning. Researchers have identified two different ways we reason called System 1 and 2, or Fast and Slow Thinking.1 Fast thinking draws upon our experience and is intuitive and automatic, while slow thinking is deliberative and rational. When first learning a new skill, we use mostly slow thinking and then rely upon fast thinking once the skill is mastered. A common example is learning how to drive, which becomes more and more automatic but needs to be deliberative in bad weather.

Q Is fast thinking effective during the diagnostic process?

A Without being able to move expeditiously through the diagnostic process, physicians would have difficulty seeing patients as scheduled. It is reassuring to know that fast thinking works well much of the time. Experts feel that physicians can safely rely upon it when attempting to diagnose patients with common conditions that present in typical, easily recognized ways. The very cognitive shortcuts and biases that make the process so efficient, however, can lead physicians astray. They may quickly arrive at a diagnosis and forego a more extensive exam or review of systems. Or they may rely upon an earlier thorough exam when following patients for a known condition. This happened in a number of glaucoma cases when physicians failed to regularly examine the optic nerve or compare current IOP measurements to earlier ones to check for slow changes over time. Memories of recent similar cases may also adversely influence the decision-making process. One physician in our study who had recently diagnosed giant cell arteritis gave that same diagnosis to a patient who ended up having a retinal detachment.

Q How can I tell when I need to switch to slow thinking?

A Slow thinking is obviously needed for complex presentations, and physicians readily engage it when they are puzzled by findings or unsure of a diagnosis. The prevalence of diagnostic errors indicates that physicians cannot easily determine when a more deliberative approach is needed. There are quick ways to check to see if you need to conduct a more thorough evaluation or change your diagnosis. The first is to take a “diagnostic time out” to get a second opinion from yourself. Asking yourself, “Could this be something else?” prompts you to seek alternative explanations and develop a differential diagnosis. “If I’m wrong, what don’t I want this to be?” helps take the worst case scenario into account. Challenge your diagnosis by checking for unexplained findings, test results that are surprising, or patients whose condition is worsening despite treatment. There will always be uncertainty. The goal is to establish a working diagnosis that allows you to move the diagnostic process and treatment forward and then to revise the diagnosis based upon tests results and the patient’s course.

Q How can I involve patients in the diagnostic process?

A The Institute of Medicine recently published a book-length analysis titled “Improving Diagnosis in Health Care.”2 It identified the patient as key to the diagnostic process by defining diagnostic error as “the failure to (a) establish an accurate and timely explanation of the patient’s health problem(s) or (b) communicate that explanation to the patient.” The report made some suggestions. Clarify that arriving at a diagnosis is a process that takes time. Explain to the patient what you think is causing the condition and then ask if your explanation makes sense to the patient. Share uncertainty. This lesson was hard-earned by one physician in our study who did not determine the cause of vision loss. He reported after his lawsuit was settled that he now lets patients know when he has not yet found a cause for the vision loss and makes sure to discuss unexplained vision loss with colleagues.

-

- See, for example, Daniel Kahneman. “Thinking: fast and slow.” Farrar, Straus, and Giroux. 2011.

- National Academies of Sciences, Engineering, and Medicine. “Improving diagnosis in health care.” Washington DC: The National Academies Press. 2015.