Defending Ophthalmology

2025 Highlights

- Consistent policyholder growth passing 6,500 physician-insureds

- Strong partnership with the American Academy of Ophthalmology (AAO), including long-term strategic initiatives and support

- Superior Financials and reaffirmed “A” Excellent A.M. Best Rating with “Strongest Level” Balance Sheet

- New website and risk management resources

unmatched success

At OMIC, protecting our policyholders is more than our mission—it’s our proven strength.

Year after year, we outperform the medical liability insurance industry across every major measure of claims defense, including a higher percentage of claims closed without payment to plaintiffs, lower average settlement amounts, reduced expenses per claim, and a superior trial win rate.

No other insurer in the nation matches our depth of experience. Our record of success in defending ophthalmic claims sets us apart from the traditional insurance industry.

OMIC consistently outperforms the industry average in all major claims defense benchmarks.

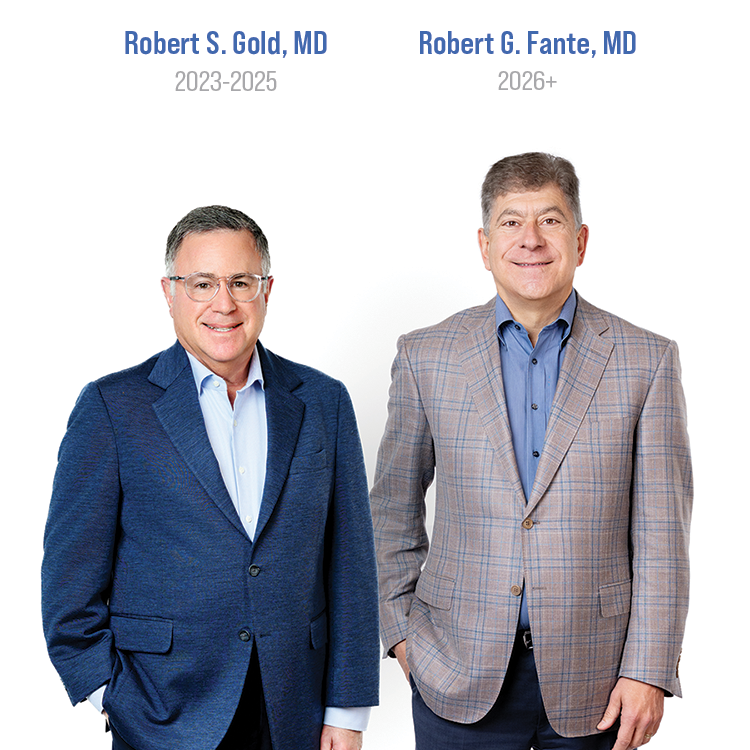

Message from the Chair

As I reach the conclusion of my three-year term as Chair of the Board of Directors, I am filled with both gratitude and pride for the tremendous progress our company has made. It has been a distinct privilege to serve you in this role while continuing my work as a practicing pediatric ophthalmologist in Orlando, Florida— an experience that has deeply informed my perspective and strengthened my commitment to our mission.

Over the past three years, OMIC has experienced remarkable growth. We have seen a significant increase in the number of policyholders who trust us to protect their professional livelihoods, and our financial strength has deepened through meaningful increases in both our corporate assets and policyholders' surplus. Additionally, we continue to reward your loyalty to OMIC by declaring significant dividend returns. These gains reflect the tireless efforts of our management team, staff, and board to ensure that we remain a secure, reliable partner for the ophthalmic community.

Among the most pivotal achievements during my tenure was the recruitment of a new President and Chief Executive Officer, Bill Fleming, in 2024. Under Bill’s leadership, we are already seeing the benefits of fresh strategic vision, operational innovation, and renewed energy. OMIC is a well-oiled machine and on track for another year of success. His appointment marked a critical investment in the future of our organization.

Equally important has been the continued strengthening of our relationship with our primary partner and sponsor, the American Academy of Ophthalmology. This partnership is foundational to our identity and success, and we remain aligned in our shared commitment to safeguarding the practice of ophthalmology and the patients we serve. During my tenure, I am most proud of our strengthened ties, including reaffirmation of our exclusive AAO sponsorship, commitment to our office space within the Academy’s building, and participation in the creation of the Parke Center, which has improved our technological capabilities and lowered costs for future meetings and events. In recognition of OMIC’s patient safety initiatives and OMIC’s long-term support of ophthalmology, the Academy awarded our company with the prestigious Distinguished Service Award, which I proudly accepted on behalf of our amazing team.

I want to extend my sincere thanks to my fellow board members for their unwavering dedication, wisdom, and collaboration. I am confident that OMIC’s strong governance, reliable leadership, and shared purpose will continue to propel the company forward in the years to come.

I am excited to pass the baton to my colleague, Dr. Robert G. Fante, as Chair of the Board beginning January 1, 2026. I can think of no one more prepared and capable than Rob to lead OMIC into the future.

On behalf of our Board, I would also like to recognize our colleague, Dr. Ronald W. Pelton, who is also reaching the maximum term of service allowed under OMIC’s bylaws at year-end. Dr. Pelton’s influence on our company has been significant to say the least, culminating in his role as Chair of the Finance Committee and Treasurer during some of OMIC’s most impressive financial achievements. During his tenure we outperformed the industry in nearly every benchmark used to evaluate performance for companies such as ours. Another pivotal member of OMIC’s Board, Dr. Christie L. Morse, will assume these roles moving forward.

Finally, thank you, our policyholders, for the incredible opportunity to serve this exceptional organization. It has been one of the great honors of my professional career.

Robert S. Gold, MD

Mission-Driven Excellence

At the core of OMIC’s operations is a clear and enduring mission: to protect American Academic of Ophthalmology members, eye care entities, and patients by providing comprehensive, affordable liability insurance and best-in-class risk management and claims defense services.

OMIC is equally committed to advancing quality ophthalmic care and promoting patient safety, reinforcing our leadership role within the broader medical liability community.

A legacy of growth, leadership & stewardship

Since its founding in 1987, OMIC has achieved uninterrupted annual growth in its policyholder base. Averaging a 6% increase in insured members each year, OMIC’s expansion is a direct reflection of the trust and confidence ophthalmologists place in our mission and service. This consistent growth across nearly four decades speaks to our steadfast commitment to serving the ophthalmic community with excellence and integrity.

NATIONWIDE LEADERSHIP IN OPHTHALMIC COVERAGE

OMIC is the largest insurer of ophthalmologists in private practice in every region of the United States. We have achieved market dominance in 34 states and the District of Columbia, where OMIC insures more than half of all ophthalmologists in private practice. OMIC is also the leader in coverage for alternative structures such as private-equity affiliated ophthalmology. Our commanding market share affirms our reputation as the only carrier that is specialized, reliable, and responsive to the specific medical liability insurance needs for ophthalmologists.

of ophthalmic practice

The ability to deliver high-quality, accessible ophthalmic care is under increasing threat. Across the nation, long-standing caps on medical malpractice awards—critical protections that help keep insurance premiums stable and practice costs manageable—are being challenged in courts and legislatures.

If these caps are overturned or weakened, we can expect a surge in high-dollar verdicts and runaway settlement demands. The result will be rapidly rising malpractice premiums, greater financial strain on practices, and, in some cases, the reduction or elimination of certain services. Ultimately, this would harm both the viability of your practice and the patients who rely on you for care.

The Stakes Are High

Without reasonable limits on non-economic damages, malpractice litigation becomes more unpredictable and costly. History and data show that:

- Premium increases follow closely after cap removals.

- Smaller practices and those in rural or underserved areas feel the impact first and most severely.

- Larger practices become targets as plaintiff attorneys see more opportunities and incentives for pursuing frivolous claims and more claims involve multiple defendants.

- Patient access is threatened when providers must limit services or close their doors due to cost pressures.

The fight to preserve these caps is being waged state-by-state, often with little public awareness. In many states, this work is being done by state ophthalmic societies, subspecialty groups, and broader medical alliances. These organizations are our first and strongest line of defense, but they cannot succeed without your engagement and support.

How You Can Help

The future of ophthalmic practice depends on defending reasonable malpractice laws, including damage caps that keep liability insurance affordable and care accessible. We urge every OMIC policyholder to:

- Contact your local and state representatives—both in writing and in person—to demand the protection and expansion of tort reform measures, including malpractice award caps. Explain how these laws safeguard patient access, maintain practice viability, and control healthcare costs.

- Join and actively participate in your state ophthalmic society and subspecialty organizations. They are leading the fight to defend our profession.

- Respond to advocacy alerts from your professional societies by emailing or calling legislators when key votes are scheduled.

- Educate your patients and community about the importance of fair, balanced malpractice laws for the future of healthcare.

- Support state and national advocacy partners financially, ensuring they have the resources to counter well-funded opposition efforts.

Our Shared Responsibility

OMIC is committed to providing the strongest defense possible against malpractice claims, but we cannot control the legal climate in which we operate. That’s why your participation in advocacy—at the state, subspecialty, and national levels—is essential. Together, we can help ensure that our profession remains viable, sustainable, and dedicated to patient care for decades to come.

Let’s protect the future of ophthalmology—together.

Supporting our partner societies—and your savings

Since 1994, OMIC has partnered with ophthalmic societies to help offset their members’ dues while rewarding our insureds. By leveraging marketing efficiencies from recruiting new insureds who are active in these societies, we’ve been able to grow our policyholder base and pass the savings back to you.

Through these partnerships, referrals from our society allies have fueled steady growth, creating economies of scale that allow us to offer lower premiums. To date, OMIC has provided more than $39 million in cumulative premium discounts to society partner members.

As part of this ongoing commitment, OMIC offers a 5% premium discount each year to insureds who are members of one or more partner societies. To ensure you receive your discount automatically, simply update your OMIC profile online to reflect your current memberships.

Our long-standing support for ophthalmic societies continues to strengthen the profession while helping to keep your coverage affordable.

Message from the CEO

There’s something quietly remarkable about a bullet train arriving at a station. Imagine standing on a platform in Tokyo as the Shinkansen glides to its stop — not just on time, but within seconds of its scheduled arrival. Precise, efficient, and on schedule. For passengers, this reliability becomes routine. Expected. Trusted.

At OMIC, we view our mission in much the same way.

Our goal is to operate with the same clarity of purpose and consistent performance. Insureds expect that their coverage is sound and their company is strong enough to stand by them in moments that matter. This should always be a given. And for us, it is.

Because OMIC’s success is built on deeply embedded discipline and continuous vigilance within our singular specialty, we focus specifically on monitoring risk like dispatchers watching the tracks. We respond to shifts in our landscape with speed and precision, no matter what curves lie ahead. Whether it’s offering timely risk management resources or expert guidance in moments of uncertainty, we strive to be that dependable train pulling into the station exactly when it should.

If OMIC is performing at our best, dependable service becomes a background constant, a foundation you count on without question. And that is precisely how I view the role of our executive team and employees. The crux of our performance revolves around us “keeping the trains running on time,” meaning service to insureds provided by each one of us at OMIC.

On this score, we performed very well again in 2025. Whenever I meet with insureds or brokers, I consistently get very positive feedback about the service they receive. Our surveys of policyholders who have been sued describe high satisfaction rates throughout the claims defense process, which is our most important responsibility.

Because OMIC is an insurance company, it’s vital that it remain financially sound. I am pleased to report that OMIC’s A.M. Best rating was affirmed as “A” Excellent in 2025 with our balance sheet noted as being at the “strongest level.” Our admitted assets, direct written premium, investment and net income, and policyholders’ surplus all increased through mid-year. While claims activity has increased as well, OMIC is well positioned to meet or exceed our major financial benchmark projections by year-end.

At times, there will be obstacles before us on the tracks. When identified, we will slow to clear them from our path. An example of this has been OMIC’s response to the increasing hostility of the legal system toward the medical profession, among others. While ophthalmology remains lower risk than other aspects of medical professional liability, it is not immune. This has resulted in significant increases in the number and cost of claims. Current conditions require that we absorb, and sometimes adjust for, increased claim costs, even as we work diligently to reduce our operating expenses. We have also successfully managed our investment portfolio, allowing us to cover some of the increased claim costs with investment income.

Our team has taken several steps to reduce expenses whenever possible. We’ve streamlined systems, renegotiated contracts, and adjusted our reinsurance, the coverage we purchase in order to protect OMIC, so that we may mitigate impact on your premium while still protecting the company from aberrant losses. While adjustments are still sometimes necessary due to increased costs, fortunately our positive performance from past coverage years allows us to offset the impact by also declaring dividends. In keeping with this commitment, OMIC will implement an average 5.4% rate adjustment, while crediting our physician’s renewal premiums with a 5% dividend. You have my word: we remain committed to returning to you any premium above which is needed to prudently operate OMIC.

Thank you to all insureds and partners for allowing us the privilege to serve you.

Bill Fleming

A LEADER IN FINANCIAL STEWARDSHIP AND DIVIDENDS

OMIC’s superior operational performance has enabled us to return value to our policyholders year after year. Over the past decade, only 25% of the 50 medical liability insurers consistently issued dividends—OMIC among them. More than half of our peers issued no dividends at all. OMIC’s average dividend of 10.3% over that period significantly outpaced the industry average, underscoring our financial strength and member-first philosophy.

Even more striking, in 2024 only 13 of 56 carriers in our industry issued a dividend.

In a time of rising costs and economic uncertainty, OMIC remains unique and among a small select group of companies that continue to issue dividends. To date, we have declared more than $113 million in policyholder dividends during 31 of 39 years in business, a reflection of both our financial discipline and our unwavering commitment to sharing success with our insureds.

As we’ve returned money above which was needed to prudently operate OMIC through dividend credits, we’ve also kept rates relatively stable throughout recent inflationary periods. OMIC’s rates increased an average of 2.3% during the past decade, while the Consumer Price Index (CPI) for the same period in the U.S. shows an increase of 34%, or an average of 3.3%.

Financial strength that protects our members

OMIC maintains the strongest level of risk-adjusted capitalization in the industry, as measured by A.M. Best Company, the leading independent insurance rating agency. This superior rating reflects our ability to meet policyholder obligations under any circumstances—today and well into the future.

Our financial position is not the result of short-term gains, but of a long-standing history of organic surplus growth, built steadily over decades. Remarkably, we have achieved this growth while returning substantial dividends to our policyholders, year after year. This is more than a financial accomplishment—it is a demonstration of our commitment to operate in the best interest of our members, sharing the benefits of strong performance rather than retaining them solely for corporate gain.

For OMIC, financial strength is not an abstract metric—is it a promise. It ensures stability, supports competitive premiums, funds a robust defense of claims, and provides the flexibility to navigate future challenges without compromising coverage or service. Our combination of exceptional capitalization, consistent surplus growth, and meaningful policyholder dividends is unmatched in the ophthalmic malpractice insurance industry.

OPHTHALMIC MUTUAL INSURANCE COMPANY

- Loss & Loss Expense Ratio measures a company’s loss experience in relation to its earned premium.

- Combined Ratio measures the company’s overall underwriting profitability. A combined ratio of less than 100 indicates an underwriting profit.

- Operating Ratio measures a company’s overall profitability from underwriting and investment activity (pretax).

- Net Written Premium to Surplus Ratio is a leverage measure used to evaluate the adequacy of an insurer’s surplus. A ratio of less than 300% generally indicates acceptable financial health.

Board, staff & advisors

OMIC is supported by a dedicated team whose leadership and expertise strengthen our service to members.

2025 Board of Directors